What Is The Inheritance Tax Threshold In 2025. What is the inheritance tax threshold? Inheritance tax additional threshold (residence nil rate band) — from 6 april 2017.

Section 7 of the inheritance tax act 1984 (ihta) provides for the rates of iht to be as set out in the table in schedule 1. But her friend (not the estate) must pay inheritance tax on the £100,000 given to them, at a rate of 32%, as this was given by sally after she’d breached the inheritance.

Tax experts are divided on the ideal tax income tax slabs and income tax rates under the new tax regime.

Threshold For Inheritance Tax 2025 Johna Madella, Explore anticipated personal tax reforms in india's 2025 union budget, including tax rate adjustments, increased exemption limits, and simplified tax regimes. Check if an estate qualifies for the inheritance tax residence nil rate band;

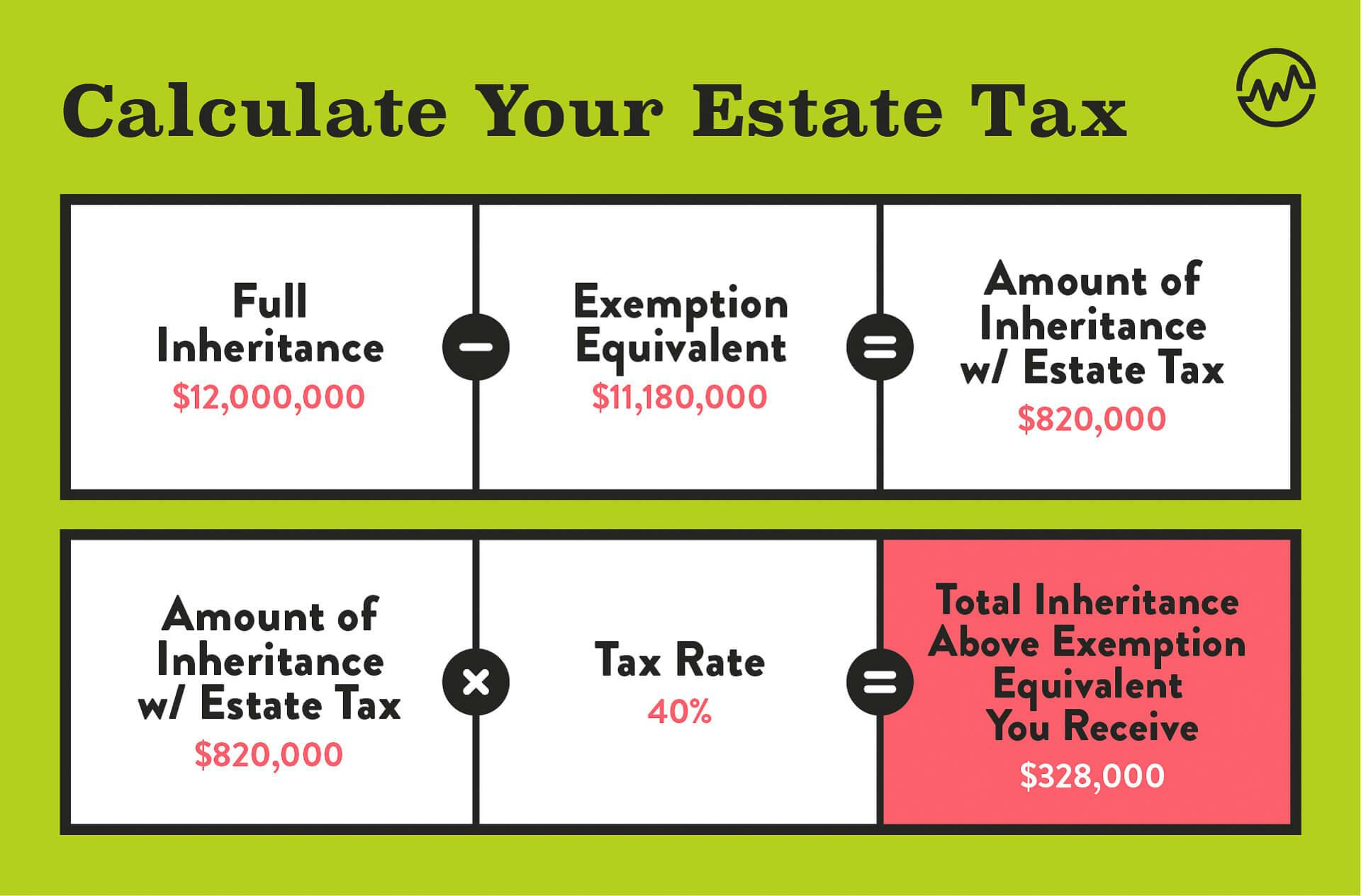

How Much Is Inheritance Tax 2025 Usa Lenka Nicolea, Inheritance tax thresholds and interest rates; As of 2025, the nrb is £325,000.

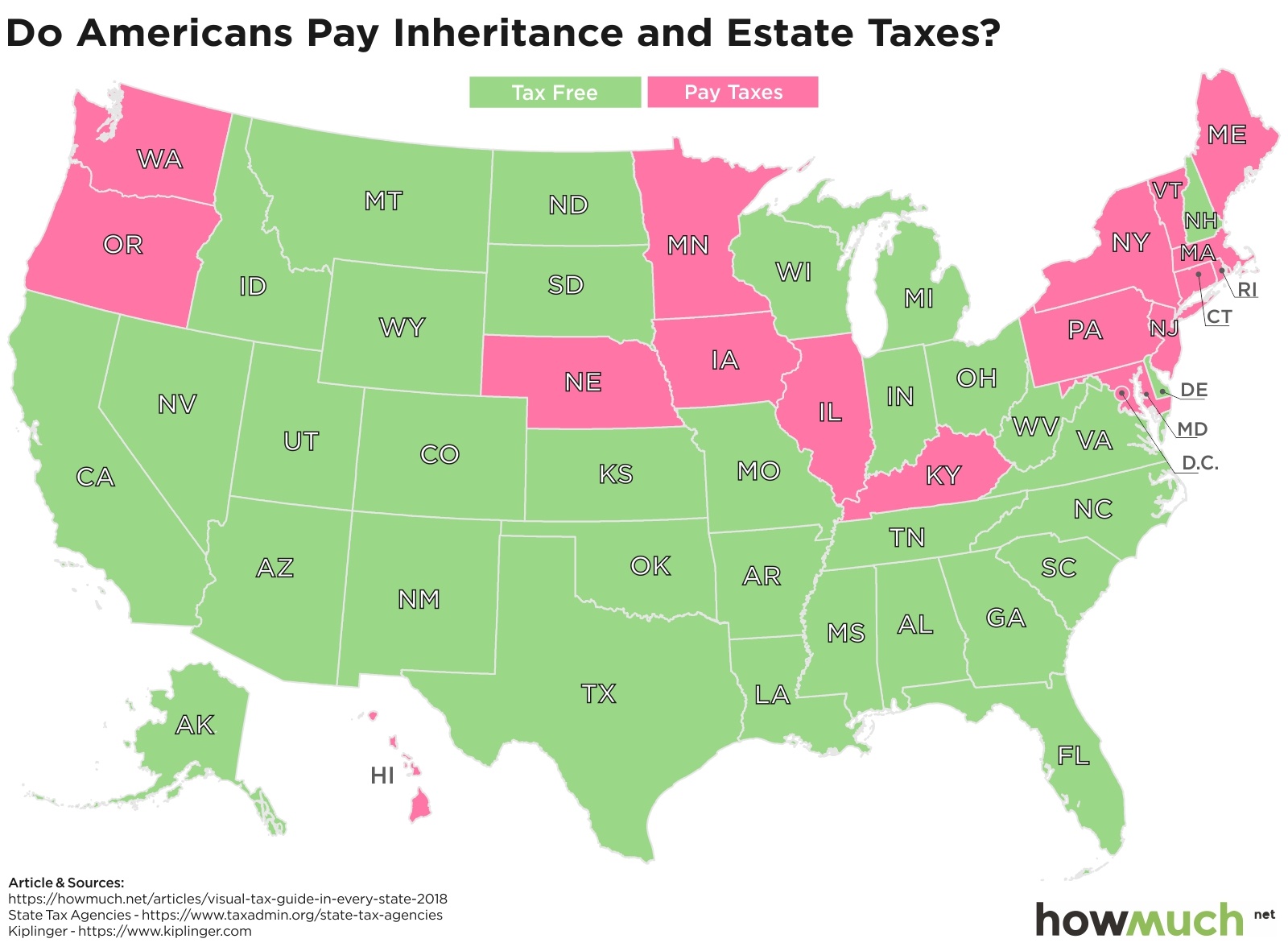

States With Inheritance Tax 2025 Kippy Merrill, Under the current rules, children are. Inheritance tax (iht) is levied on the value of all the assets in an individual’s estate on death, after deducting any liabilities, exemptions and reliefs.

Inheritance Tax Changes 2025 Clem Melita, As of 2025, the nrb is £325,000. Your spouse or civil partner has the same allowance, effectively doubling what you can pass on to £350,000.

Maryland Estate Taxes 2025 Dinny Frances, As it stands, a 40 percent tax charge is applied to estates which exceed the £325,000 threshold for iht. Section 7 of the inheritance tax act 1984 (ihta) provides for the rates of iht to be as set out in the table in schedule 1.

What is the inheritance tax threshold and how does it work? The, For example, if your estate is worth. They will also receive your £325,000 inheritance tax threshold and the property limit of £175,000.

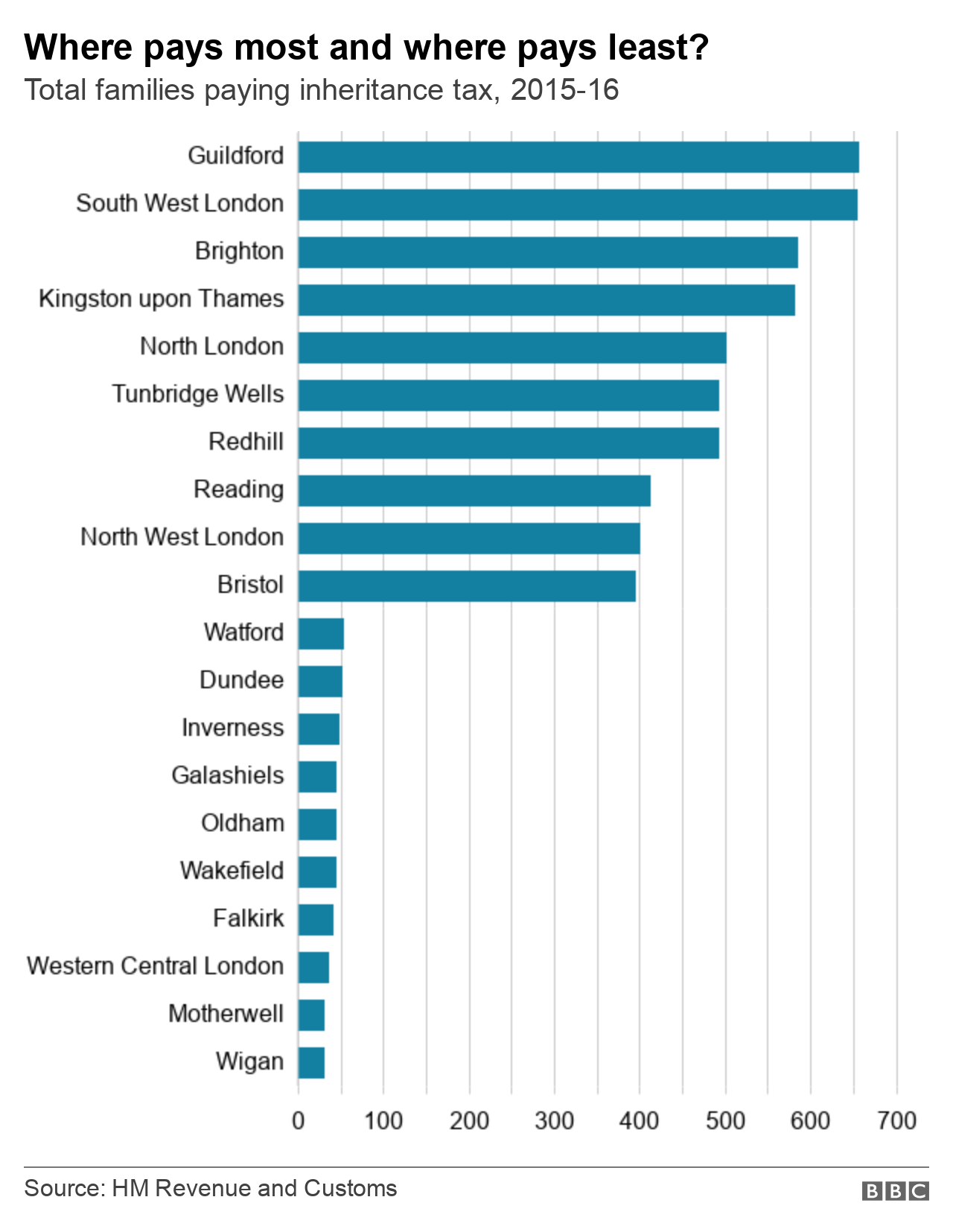

Inheritance Tax Changes 2025 Clem Melita, Inheritance tax (iht) is levied on the value of all the assets in an individual’s estate on death, after deducting any liabilities, exemptions and reliefs. At £6bn it is a less costly reform for government than reducing the headline iht rate, while simplifying the tax.

Uk Inheritance Tax Threshold 2025 Shina Dorolisa, Income tax benefits from budget 2025: New analysis from quilter, the wealth manager and.

:max_bytes(150000):strip_icc()/Inheritance_Tax_Final-c5902af4dd0e49918533982c240cf419.jpg)

Inheritance Tax What It Is, How It's Calculated, and Who Pays It, Your spouse or civil partner has the same allowance, effectively doubling what you can pass on to £350,000. Due to fiscal drag, where incomes have increased while tax.

State Withholding Tax Table 2025 Sari Winnah, However, most agree that the 30% tax slab above an. The government has previously announced that the inheritance tax (iht).