Corporate Income Tax Rate Singapore 2025. This is part of a $1.3 billion. The ftc scheme provides for a concessionary tax rate of 8% on income derived from qualifying ftc services to approved network companies and qualifying ftc activities.

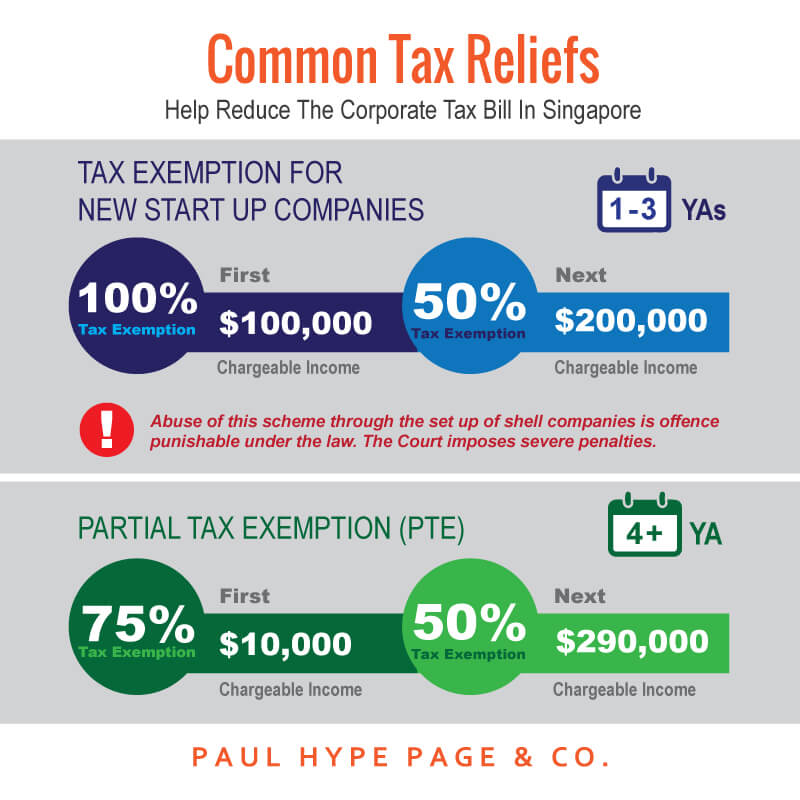

To help companies manage rising costs, a cit rebate of 50% of tax payable will be granted for ya 2025, capped at. Corporate income tax (cit) rebate of 50% and a cit rebate cash grant of 2,000 singapore dollars (sgd) for eligible.

Guide to Corporate Tax in Singapore 2025 Optimizing Tax Strategies A, Singapore has a preceding year basis of taxation;

Corporate Tax Rates For 2025 Image to u, What is the current corporate tax rate in singapore and how to calculate it?

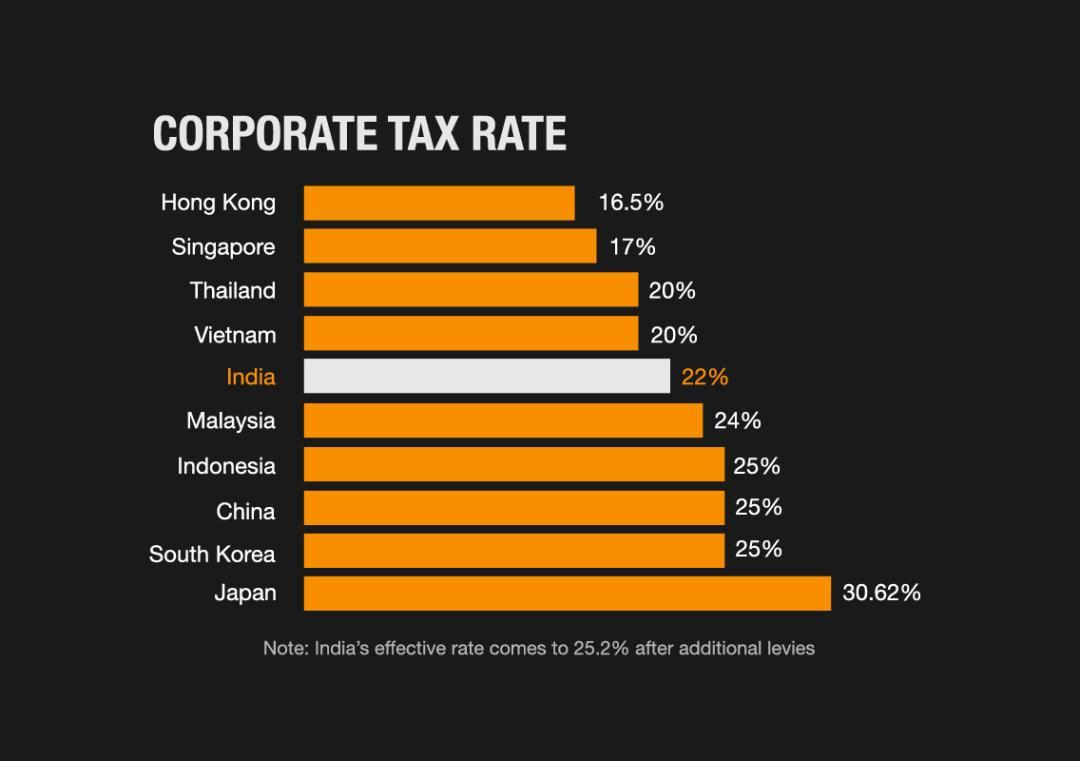

Doing Business in Singapore vs. India Comparative Report, Singapore's flat and fixed tax rate makes it an attractive destination for businesses.

Facts About Corporate Taxes in Singapore Singapore Taxation, Corporate income tax (cit) rebate.

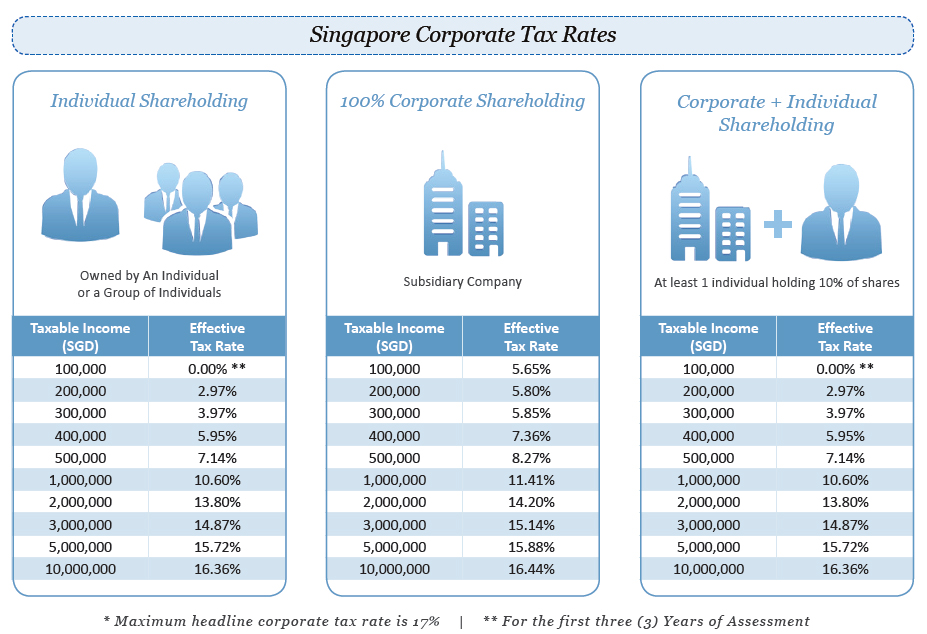

singapore tax rate Singapore Personal Tax Rates hamcisko, Businesses that have their income derived from singapore or income remitted to the country are obligated to pay corporate taxes at a rate of 17 percent on their.

Essential Guide to Reducing Corporate Tax in Singapore A Book Of Finance, Corporate income tax (cit) rebate.

Individual Tax Rates 2025 Singapore Image to u, Discover the key details of corporate tax in singapore, including incentives, types of returns, and how to file them.

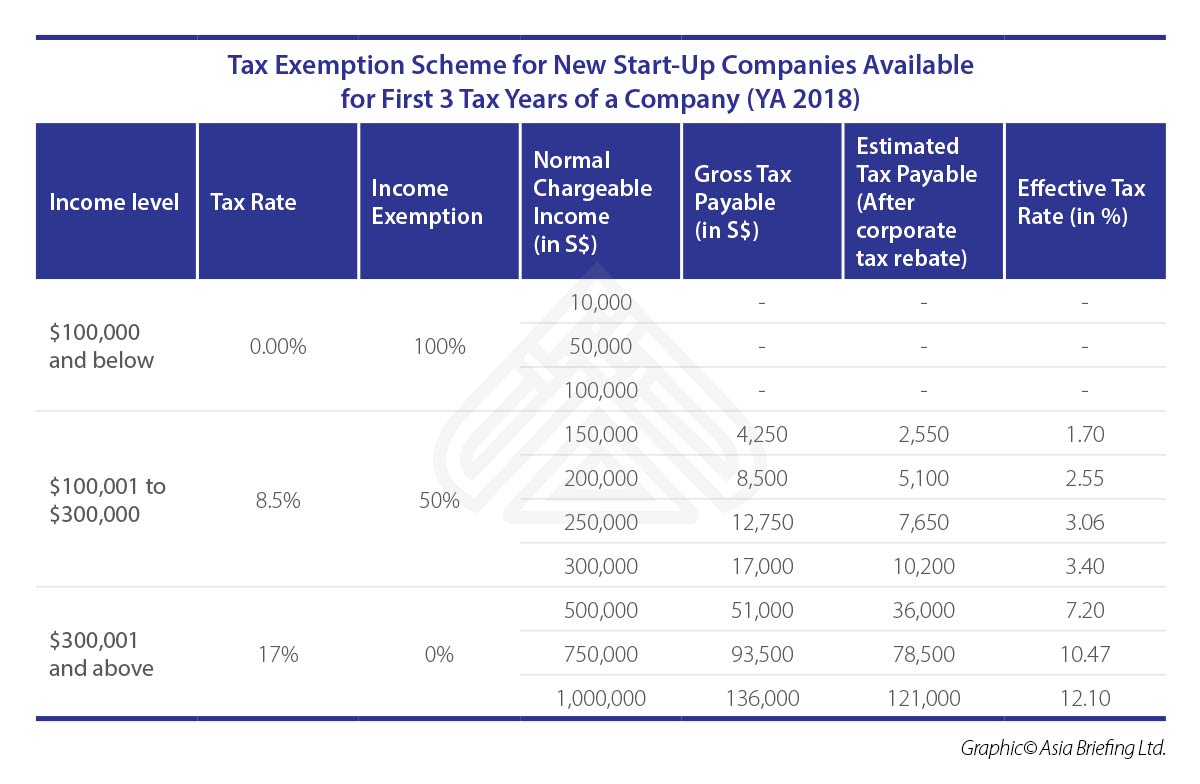

Asiapedia Singapore's Corporate Tax Quick Facts Dezan, Singapore's headline corporate tax rate is 17%, however, due to numerous tax incentives and tax breaks, the effective tax rate for most singapore companies is.